For tax purposes traders are required to keep track of their profits or losses. A capital gains calculator can be used to determine the adjusted cost basis for your stocks, which will be needed to determine your actual gains/loss.

Capital Gains Calculator Excel. This was tested to work in both Microsoft Excel and Open Office. For more on adjusted cost basis see our average cost calculator.

Capital Gains Calculator Excel. This was tested to work in both Microsoft Excel and Open Office. For more on adjusted cost basis see our average cost calculator.

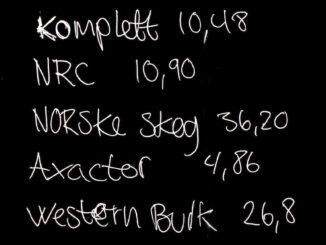

To use the spreadsheet to calculate capital gains or adjusted cost basis simply input the date, type of transaction (BUY, SELL or ROC), number of shares, price / share and commission to compute the adjusted cost basis and the final share balances.

Adjusted cost basis determines the price you paid over one or more BUYS. For example: you buy 200 shares at $2 for $400. Later on you buy 200 shares at $3 or $600, for a final ACB of $1000 at an average share price of $2.50. From the ACB you can then determine your gains / losses.

I left an example for each sheet so you can get an idea how it works. Since I am in Canada I am working my results in Canadian dollars but you can use whatever you like. The 2nd sheet has no exchange rate column so if you are not Canadian or just trading US stocks, you can use that. You can adjust everything to your needs.

Be the first to comment