American Hotel Income Properties Announces Agreement to Acquire 12 Premium Branded Hotels for $191.0 Million

PR Newswire

VANCOUVER, Nov. 28, 2019

AHIP also confirms completion of the previously announced profitable sale

of the Economy Lodging portfolio for gross proceeds of $215.5 million

- Acquisition of the 12 Premium Branded hotels at an approximate 8% capitalization rate

- The hotels, all built in the last five years, are being acquired below replacement cost

- Transaction follows completion of the sale of the Economy Lodging portfolio; AHIP is now exclusively a premium branded hotel REIT

- The acquisition will be financed using proceeds from the sale of the Economy Lodging portfolio and a new interest-only fixed-rate term loan

(All numbers are in U.S. dollars unless otherwise indicated)

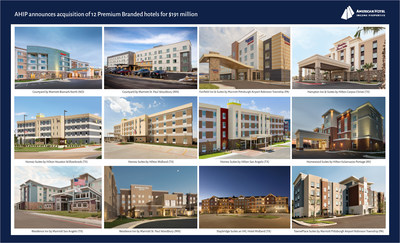

VANCOUVER, Nov. 28, 2019 /PRNewswire/ – American Hotel Income Properties REIT LP (“AHIP“, the “Company“) (TSX: HOT.UN, TSX: HOT.U, TSX: HOT.DB.U) is pleased to announce that it has reached a definitive agreement (the “Definitive Agreement“) to acquire a portfolio of 12 well-maintained Premium Branded hotels (the “Acquisition”) for $191.0 million excluding closing and post-closing adjustments. The 12 hotels, totaling 1,203 guestrooms, are located across the United States and will significantly strengthen AHIP’s geographic presence in Texas and the Midwest. The properties have all been constructed within the past five years, are stabilized and have minimal brand mandated property improvement plans. The transaction is expected to close during December 2019, at which point AHIP’s portfolio will consist of 79 Premium Branded hotels, representing 8,887 total guestrooms, that are licensed primarily with Marriott, Hilton and IHG.

“We’re very excited to complete a significant component of our 2019 capital recycling program by adding these 12 high-quality, mostly all-suite focused, recently built select-service hotels to our portfolio of Premium Branded hotels,” said John O’Neill, CEO. “We’re especially pleased with the acquisition cap rate and short closing timeline for this transaction, as the cash flow from these newer hotels will minimize the dilution from the sale of the Economy Lodging portfolio. With no major capital renovations required, the hotels in this portfolio should perform without any income displacement. In addition, the improved debt financing terms we’ve secured for this transaction, including interest only payments at lower fixed interest rates, will meaningfully reduce our financing costs and drive higher cash flows. We continue to believe higher-quality properties and attractive financing terms will drive better risk-adjusted FFO accretion and create value for our unitholders over the long term.”

AHIP intends to use net proceeds from the sale of its Economy Lodging portfolio, alongside an approximately $105 million new fixed-rate term loan to finance the Acquisition. Specifically, the facility will have a five-year term with fixed interest rates less than 4%, secured by the 12 new hotel properties. Exact debt terms will be confirmed at the time the Acquisition closes. The hotels are being acquired for approximately $158,800 per key, which is below AHIP’s estimate of replacement cost.

The 12 hotels in the Acquisition include six Marriott branded properties (two Courtyards, two Residence Inns, one Fairfield Inn & Suites and one TownePlace property), five Hilton branded properties (three Home2 Suites, one Hampton Inn and one Homewood Suites), and one IHG branded property (a Staybridge Suites). Eight of the twelve hotels are all-suite products and all of these brands are complementary to AHIP’s existing hotel portfolio of select-service, premium branded, upper-midscale to upper-upscale properties. Importantly, all of the properties are already managed by Aimbridge Hospitality – AHIP’s exclusive hotel manager, which should ensure a seamless transition into AHIP’s portfolio.

The Acquisition also further diversifies AHIP’s geographic markets, strengthening the Company’s presence in markets outside of the U.S. East Coast. Six of the new hotels are located in Texas, while the remainder are located in the Midwest (Michigan, Minnesota, North Dakota and Pennsylvania). In line with AHIP’s long-term strategy, all 12 hotels are located in metropolitan secondary markets that benefit from multiple demand generators and industries to support the local economies.

THE ACQUISITION PORTFOLIO

|

HOTEL |

LOCATION |

HOTEL BRAND |

YEAR BUILT |

# of ROOMS |

|

Courtyard St. Paul Woodbury (Minneapolis) |

Woodbury, MN

|

Marriott

|

2018

|

120

|

|

Residence Inn St. Paul Woodbury (Minneapolis) |

Woodbury, MN

|

Marriott

|

2016

|

116

|

|

Home2 Suites Houston Willowbrook |

Houston, TX

|

Hilton

|

2016

|

108

|

|

Fairfield Inn & Suites Pittsburgh Airport Robinson Township |

Pittsburgh, PA

|

Marriott

|

2015

|

103

|

|

Hampton Inn & Suites Corpus Christi |

Corpus Christi, TX

|

Hilton

|

2015

|

101

|

|

Staybridge Suites Midland |

Midland, TX |

IHG |

2015 |

98 |

|

Homewood Suites Kalamazoo Portage |

Portage, MI

|

Hilton

|

2015

|

97

|

|

Home2 Suites Midland |

Midland, TX |

Hilton |

2015 |

93 |

|

Home2 Suites San Angelo |

San Angelo, TX |

Hilton |

2015 |

93 |

|

TownePlace Suites Pittsburgh Airport Robinson Township |

Pittsburgh, PA

|

Marriott

|

2016

|

93

|

|

Residence Inn San Angelo |

San Angelo, TX |

Marriott |

2015 |

92 |

|

Courtyard Bismarck North |

Bismarck, ND |

Marriott |

2014 |

89 |

COMPLETION OF THE PREVIOUSLY ANNOUNCED SALE OF THE ECONOMY LODGING PORTFOLIO

AHIP is also pleased to confirm that it has now closed the previously announced sale of its Economy Lodging portfolio of 45 hotels to VCM Ltd. (an affiliate of Vukota Capital Management), for total gross proceeds of $215.5 million excluding closing and post-closing adjustments, effective today. This profitable sale culminates an extensive review of the portfolio that reinforced AHIP’s view that its long-term strategy is better focused on expanding and driving growth from its Premium Branded select-service hotel portfolio.

In connection with closing of this transaction, AHIP has agreed that approximately $7.0 million of the gross proceeds will be subject to an earn-out to be settled in the next 12 months based on the achievement of certain criteria. In addition, AHIP has agreed to pre-fund from the gross proceeds a maximum of $7.4 million of brand mandated property improvement plans for the Economy Lodging hotels with a credit for any cost savings.

ABOUT AMERICAN HOTEL INCOME PROPERTIES REIT LP

American Hotel Income Properties REIT LP (TSX: HOT.UN, TSX: HOT.U, TSX: HOT.DB.U), is a limited partnership formed to invest in hotel real estate properties located in the United States. AHIP is actively engaged in growing its portfolio of premium branded, select-service hotels in larger secondary markets that have diverse and stable demand. AHIP hotels operate under brands affiliated with Marriott, Hilton, IHG, Wyndham and Choice Hotels through license agreements. The Company’s long-term objectives are to build on its proven track record of successful investment, deliver reliable and consistent U.S. dollar denominated distributions to unitholders, and generate value through the continued growth of its diversified hotel portfolio. More information is available at www.ahipreit.com.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may constitute “forward-looking information” (also known as forward- looking statements) or “financial outlook” within the meaning of applicable securities laws. Forward-looking information and financial outlook involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements or industry results, to be materially different from any future results, performance or achievements or industry results expressed or implied by such forward-looking information and financial outlook. Forward-looking information and financial outlook generally can be identified by the use of terms and phrases such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “feel”, “intend”, “may”, “plan”, “predict”, “project”, “subject to”, “will”, “would”, and similar terms and phrases, including references to assumptions. Some of the specific forward-looking information and financial outlook in this news release includes, but is not limited to, statements with respect to: the Acquisition; the cost of the Acquisition; AHIP’s intention to use net proceeds from the sale of its Economy Lodging portfolio, alongside an approximately $105 million new fixed-rate term loan to finance the Acquisition; management’s view that the new debt financing will meaningfully reduce AHIP’s financing costs and drive higher cash flows; the capitalization rate associated with the Acquisition; the expected strategic impacts of the Acquisition and of continuing to pursue premium branded hotel properties; management’s view that with no major capital renovations required, the hotels comprising the Acquisition should perform without any income displacement; the pricing of the Acquisition relative to replacement cost; the expected time to completion of the Acquisition; the total number of hotels and rooms owned by AHIP after giving effect to the Acquisition; and management’s view that since all of the Acquisition hotels are already managed by Aimbridge Hospitality, there should be a seamless transition into AHIP’s portfolio.

Forward-looking information and financial outlook are based on a number of key expectations and assumptions made by AHIP, including, without limitation: the Acquisition will be completed on the terms currently contemplated; the Acquisition will be completed in accordance with the timing currently expected; all conditions to the completion to the Acquisition will be satisfied or waived and the Definitive Agreement will not be terminated prior to the completion of the sale transaction; AHIP will realize the intended benefits of the Acquisition; AHIP will achieve its strategic objectives; the debt financing terms from AHIP’s new facility will be consistent with current expectations; assumptions and expectations related to capitalization rates; a reasonably stable North American economy and stock market; the continued strength of the U.S. lodging industry; capital markets will provide AHIP with readily available access to equity and/or debt financing on terms acceptable to AHIP; AHIP will be able to successfully integrate and seamlessly transition the Acquisition properties into its portfolio; and the value of the U.S. dollar. Although the forward-looking information and financial outlook contained in this news release is based on what AHIP’s management believes to be reasonable assumptions, AHIP cannot assure investors that actual results will be consistent with such information.

Forward-looking information and financial outlook are provided for the purpose of presenting information about management’s current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. Forward-looking information and financial outlook involve significant risks and uncertainties and should not be read as guarantees of future performance or results as actual results may differ materially from those expressed or implied in such statements. Those risks and uncertainties include, among other things, risks related to: the Acquisition may not be completed on the terms, or in accordance with the timing, currently contemplated, or at all; AHIP has incurred expenses in connection with the Acquisition and will be required to pay for those expenses regardless of whether or not this transaction is completed; AHIP and the seller may not be successful in satisfying the conditions to the Acquisition; AHIP may not realize the intended benefits of the Acquisition including as a result of the failure to successfully integrate and seamlessly transition the Acquisition properties into its portfolio; AHIP may not be successful in achieving its intended strategic outcomes of the Acquisition; AHIP may not realize any of the earn-out over the next 12 months nor any credit for cost savings from brand mandated property improvement plans associated with the sale of the Economy Lodging portfolio; market financing terms are subject to change and currently contemplated financing terms may not be available for future acquisitions; and distributions are not guaranteed and may be reduced or suspended at any time at the discretion of AHIP’s board of directors. Additional information about risks and uncertainties is contained in AHIP’s Management’s Discussion and Analysis dated November 7, 2019 and annual information form for the year ended December 31, 2018, copies of which are available on SEDAR at www.sedar.com.

To the extent any forward-looking information in this news release constitute a “financial outlook” within the meaning of applicable securities laws, such information is being provided to assist investors in understanding the potential strategic and financial impact of the Acquisition on AHIP.

The forward-looking information and financial outlook contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information and financial outlook reflect management’s current beliefs and are based on information currently available to AHIP. The forward-looking information is made as of the date of this news release and AHIP assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/american-hotel-income-properties-announces-agreement-to-acquire-12-premium-branded-hotels-for-191-0-million-300966488.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/american-hotel-income-properties-announces-agreement-to-acquire-12-premium-branded-hotels-for-191-0-million-300966488.html

SOURCE American Hotel Income Properties REIT LP

Be the first to comment