Equinix to Acquire Portfolio of 24 Data Center Sites from Verizon in $3.6 Billion Deal

Deal Further Strengthens Equinix’s Global Platform; Expands Breadth and Depth of Interconnection Portfolio

PR Newswire

REDWOOD CITY, Calif., Dec. 6, 2016

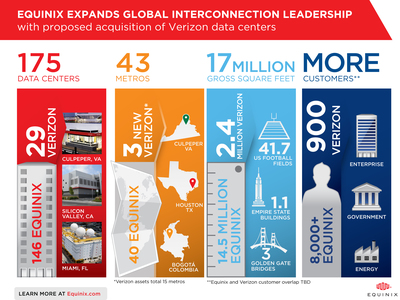

REDWOOD CITY, Calif., Dec. 6, 2016 /PRNewswire/ — Equinix, Inc. (Nasdaq: EQIX), the global interconnection and data center company, today announced it has entered into a definitive agreement to purchase a portfolio of 24 data center sites and their operations from Verizon Communications Inc. (NYSE, Nasdaq: VZ) for $3.6 billion in an all cash transaction. The 24 sites consist of 29 data center buildings across 15 metro areas. The addition of these strategic facilities and customers will further strengthen Equinix’s global platform by: increasing interconnection in the U.S. and Latin America; opening three new markets in Bogotá, Culpeper and Houston; and accelerating Equinix’s penetration of the enterprise and strategic market sectors, including government and energy.

The acquisition of these assets will enable Equinix customers to further respond to a key market trend that is enabling their evolution from traditional businesses to “digital businesses” — the need to globally interconnect with people, locations, cloud services and data. Additionally, customers will have the opportunity to operate on an expanded global platform to process, store and distribute larger volumes of latency sensitive data and applications at the digital edge, closer to end-users and local markets.

The acquired portfolio includes approximately 900 customers, with a significant number of enterprise customers new to Equinix’s platform, and it adds approximately 2.4 million gross square feet. It will bring Equinix’s total global footprint to 175 data centers in 43 markets and approximately 17 million gross square feet across the Americas, Europe and Asia-Pacific markets.

The transaction is expected to close by mid-2017, subject to the satisfaction of customary closing conditions.

Highlights / Key Facts

- The transaction includes 29 data center buildings across 24 sites in 15 metro areas, including Atlanta (Atlanta and Norcross), Bogotá, Boston (Billerica), Chicago (Westmont), Culpeper, Dallas (Irving, Richardson-Alma and Richardson-Pkwy), Denver (Englewood), Houston, Los Angeles (Torrance), Miami (Miami and Doral), New York (Carteret, Elmsford and Piscataway), São Paulo, Seattle (Kent), Silicon Valley (Santa Clara and San Jose), and Washington, D.C. (Ashburn, Manassas and Herndon).

- The addition of the new data center assets will greatly expand Equinix’s global platform for enterprises by adding new markets and Fortune 1000 enterprise customers. It expands capacity in existing markets, such as Atlanta, Denver, Miami, New York, São Paulo, Seattle and Silicon Valley, and it provides a platform for the future expansion of the acquired data centers.

- The NAP (Network Access Point) of the Americas facility in Miami is a key interconnection point and will become a strategic hub and gateway for Equinix customer deployments servicing Latin America. Combined with the Verizon data centers in Bogotá and the NAP do Brasil in São Paulo, it will strategically position Equinix in the growing Latin American market.

- The NAP of the Capital Region in Culpeper, VA is a highly secure campus focused on government agency customers, strengthening Equinix as a platform of choice for government services and service providers.

- Approximately 250 Verizon employees, primarily in the operations functions of the acquired data centers, will become Equinix employees.

- Equinix was advised by Evercore, J.P. Morgan Securities LLC and Davis Polk & Wardwell LLP.

Quotes

Steve Smith, President and CEO, Equinix:

“This unique opportunity complements and extends Equinix’s strategy to expand our global platform. It enables us to enhance cloud and network density to continue to attract enterprises, while expanding our presence in the Americas. The new assets will bring hundreds of new customers to Platform Equinix while establishing a presence in new markets and expanding our footprint in existing key metros. The deal will also provide significant value for shareholders as the proposed transaction is expected to be immediately accretive to our adjusted funds from operations per share upon close.”

Karl Strohmeyer, President, Americas, Equinix:

“This deal is a significant win for our existing customers, who will gain access to new locations, ecosystems and partners. It is also a win for the new companies joining Equinix, as they will be able to leverage Equinix’s global footprint and unique interconnection services. At Equinix, companies can architect a globally consistent platform within local metros, keeping their critical data and processing capabilities as close as possible to the digital edge and end-users.”

Investor Call

Equinix will hold an investor conference call today at 8:30 a.m. Eastern Time (5:30 a.m. Pacific Time) to discuss the details of this announcement. To hear the conference call live, please dial 1-210-234-8004 (domestic and international) and reference the passcode (EQIX). A simultaneous live Webcast of the call will be available on the company’s website at www.equinix.com, under the investor relations heading. This webcast will be recorded and available at the same location shortly after the call is concluded.

A replay of the call will be available beginning on Tuesday, December 6, 2016 (approximately one hour after the live call has concluded) through February 20, 2017 by dialing 1-203-369-4007 and referencing passcode “2016.”

Additional Resources

- Equinix Website Landing Page with Data Center Map, Photos and Additional Transaction Details[website]

- Interconnection Expanded: Equinix to Purchase 24 Data Center Sites from Victory Title of Blog [blog post]

- Colocation-Based Interconnection Will Serve as the ‘Glue’ for Advanced Digital Business Applications [Gartner Report by Bob Gill, July 2016]

About Equinix

Equinix, Inc. (Nasdaq: EQIX) connects the world’s leading businesses to their customers, employees and partners inside the most interconnected data centers. In 40 markets across five continents, Equinix is where companies come together to realize new opportunities and accelerate their business, IT and cloud strategies. www.equinix.com.

Forward Looking Statements

This press release contains forward-looking statements which are based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual results to differ materially from expectations discussed in such forward-looking statements, including statements related to the acquisition of data centers from Verizon, the expected benefits from the acquisition and the expected timing for closing the acquisition. When used in this document, the words “anticipates”, “can”, “will”, “look forward to”, “expected” and similar expressions and any other statements that are not historical facts are intended to identify those assertions as forward-looking statements. Factors that might cause such differences include, but are not limited to, the failure of one or more conditions to the acquisition of data centers from Verizon to be satisfied; the occurrence of any event, change or other circumstance that would compromise our ability to complete the acquisition of such data centers from Verizon within the expected timeframe or at all; the possibility that the anticipated benefits from the proposed acquisition cannot be fully realized or may take longer to realize than expected; unanticipated costs or difficulties relating to the integration of data centers or companies we have acquired or will acquire into Equinix, including the data centers we may acquire from Verizon; the challenges of acquiring, operating and constructing IBX centers and developing, deploying and delivering Equinix services, including in the Verizon data centers; a failure to receive significant revenue from customers in recently built out or acquired data centers, including those acquired from Verizon; failure to complete any financing arrangements contemplated from time to time; competition from existing and new competitors; the ability to generate sufficient cash flow or otherwise obtain funds to repay new or outstanding indebtedness; the loss or decline in business from our key customers; and other risks described from time to time in Equinix’s filings with the Securities and Exchange Commission. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on Equinix. In particular, see Equinix’s recent quarterly and annual reports filed with the Securities and Exchange Commission, copies of which are available upon request from Equinix. Equinix does not assume any obligation to update the forward-looking information contained in this press release.

Equinix and IBX are registered trademarks of Equinix, Inc.

International Business Exchange is a trademark of Equinix, Inc.

Be the first to comment