- Imperator | Account: -5671273 SHARES. -0

- 649 views

- Comments

- No comments yet.

- Imperator | Account: -5671273 SHARES. -270

- 47777 views

- Comments

- No comments yet.

- Imperator | Account: -5671273 SHARES. -0

- 1354 views

- Comments

- No comments yet.

- Shareholder | Account: 121 SHARES. +0

- 2390 views

- Comments

-

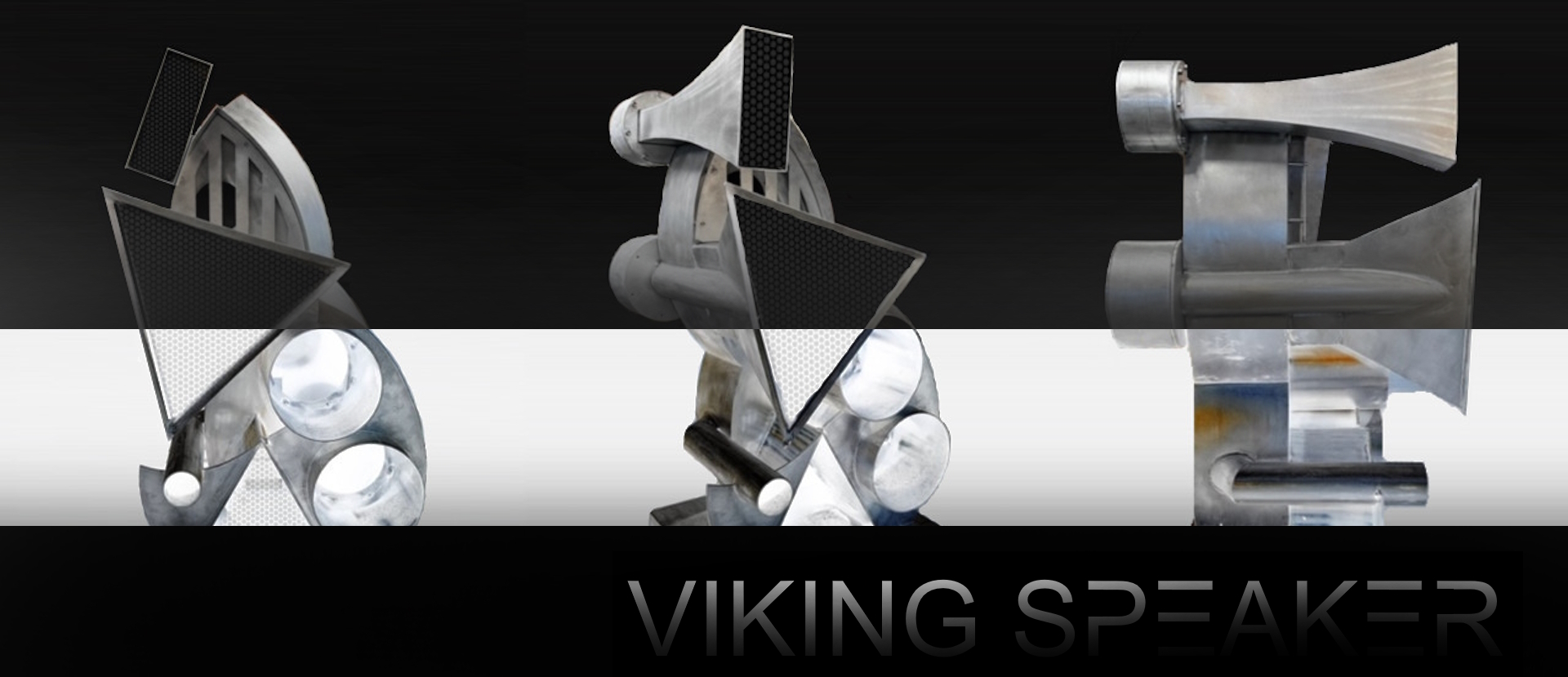

Hawkeye

Well doesn't that look tempting?

Hawkeye

Well doesn't that look tempting?

- Shareholder | Account: 121 SHARES. +0

-

"Looking damn good!" - Private Album

- 2396 views

- Comments

-

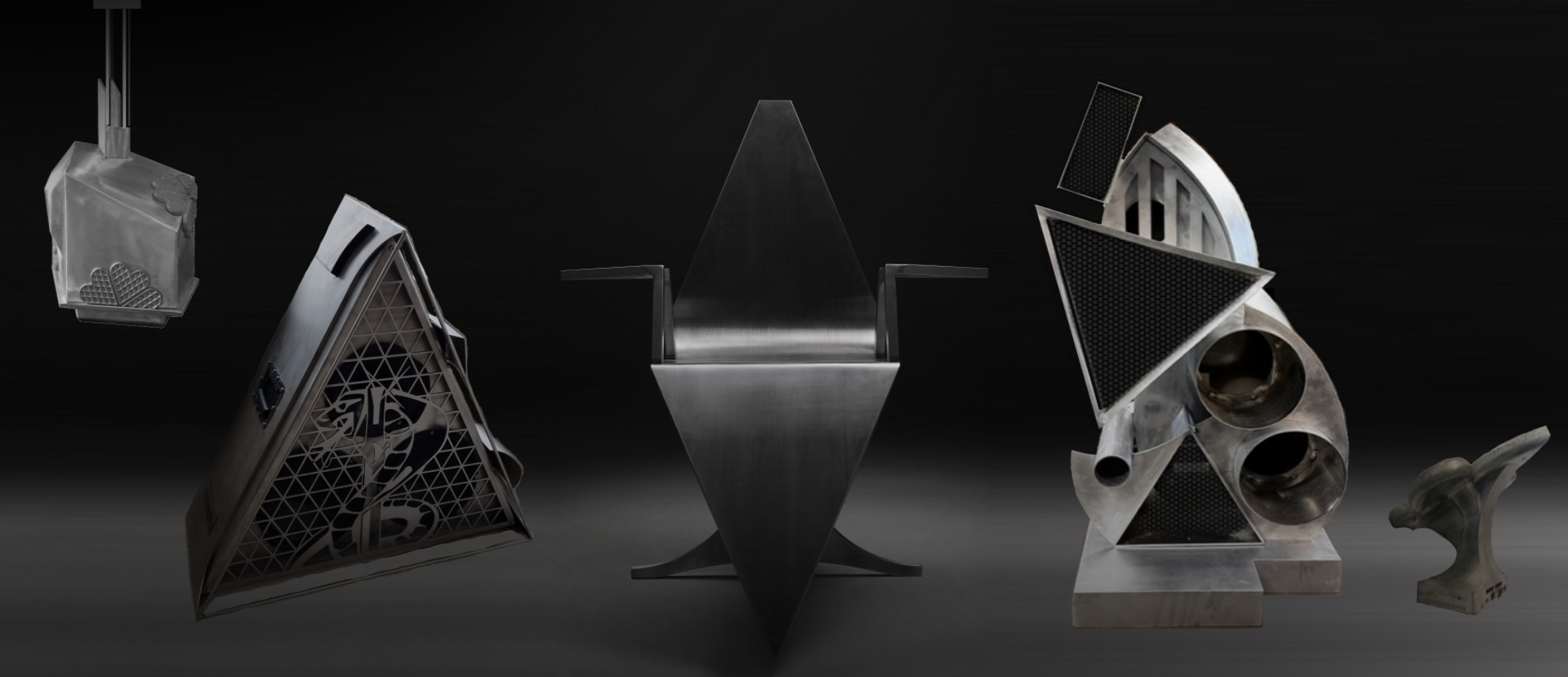

Hawkeye

Looking damn good!

Hawkeye

Looking damn good!

- Shareholder | Account: 1632 SHARES. +270

-

- 3528 views

- Comments

- No comments yet.

- Shareholder | Account: 82713 SHARES. +0

-

- 3283 views

- Comments

- No comments yet.

- Imperator | Account: -5671273 SHARES. -0

- 5357 views

- Comments

- No comments yet.

- Imperator | Account: -5671273 SHARES. -0

- 7704 views

- Comments

- No comments yet.

- Imperator | Account: -5671273 SHARES. -0

- 7828 views

- Comments

- No comments yet.

- Imperator | Account: -5671273 SHARES. -0

- 8309 views

- Comments

- No comments yet.

- Imperator | Account: -5671273 SHARES. -0

- 9953 views

- Comments

- No comments yet.

- Imperator | Account: -5671273 SHARES. -0

- 12938 views

- Comments

- No comments yet.

Anonymous

Anonymous