- Imperator | Account: -5671003 SHARES. -0

- 787 views

- Comments

- No comments yet.

- Imperator | Account: -5671003 SHARES. -0

- 1562 views

- Comments

- No comments yet.

- Imperator | Account: -5671003 SHARES. -0

-

Genprex Collaborators to Present Positive Preclinical Data on the Use of Reqorsa(R) Gene Therapy for the Treatment of Lung Cancer at the 2025 AACR-NCI-EROTC International Conference on Molecular Targets and Cancer Therapeutics - 1557 views

- Comments

- No comments yet.

- Imperator | Account: -5671003 SHARES. -0

-

Dragonfly Energy to be Awarded Nevada Tech Hub Funding to Advance Battery Manufacturing and Workforce Development

Dragonfly Energy to be Awarded Nevada Tech Hub Funding to Advance Battery Manufacturing and Workforce Development

October 2, 2025

Nevada Tech Hub selects Dragonfly Energy for first-round funding, with contract finalization in progress

Funding to support manufacturing upgrades that are expected to improve efficiency and reduce costs

Project to expand Nevada’s skilled battery workforce through new training and hiring initiatives

https://dragonflyenergy.com/dragonfly-energy-to-be-awarded-nevada-tech-hub-funding-to-advance-battery-manufacturing-and-workforce-development/ - 1708 views

- Comments

- No comments yet.

- Imperator | Account: -5671003 SHARES. -0

-

4 133,05 +20.51 +0.50%

4 133,05 +20.51 +0.50%

Gold prices notched another all-time high on Monday, crossing the $4,100-an-ounce mark for the first time, as renewed US-China trade tensions sent investors flocking to safe-haven assets.

Spot gold rose as much as 2% to $4,103.05 per ounce, a sizeable rebound from Friday’s pullback. Meanwhile, US gold futures jumped by nearly 2.9% to a high of $4,124.30 per ounce in New York. - 1734 views

- Comments

- No comments yet.

- Imperator | Account: -5671003 SHARES. -0

-

The Fens Field is a mineral deposit, approximately 5 km2, located at Ulefoss in the municipality of Nome in Telemark.

The Fens Field is a mineral deposit, approximately 5 km2, located at Ulefoss in the municipality of Nome in Telemark.

In a smaller area, 1.5 km2, Europe's largest deposit of rare earths has been discovered, estimated at 8.8 million tonnes.

The mining deposits around Ulefoss that are of economic and mining interest originate from the Fen volcano, which is a 580 million year old limestone volcano that solidified gradually with activity until 540 million years ago. The volcano was one of several that arose when Baltica and adjacent continents were broken up. Only a cross-section of a supply channel to the volcano is visible, most of the structures have been eroded away. The field extends approximately cylindrically downwards, and crystallization took place approx. 2-3 kilometres below the surface. Through explosive ascent of magmatic limestones (carbonatites), old gneiss in higher layers was transformed into a rock group that the Norwegian geologist W. C. Brøgger called fenite after the area. In total, the "fenitization" took place by various layers of lava from the Earth's mantle at a depth of 100 km, penetrating upwards and forming many metamorphic rocks. At the end of the volcanic period, water entered the carbonatites and oxidized the iron content to red hematite.

The field contains, among other things, deep and gangue rocks such as carbonatites, silicate carbonatites and nepheline pyroxenes. Søvitt is named after the farm Søve, melteigitte after Melteig, whipetoite after Vipeto and damtjernite after Damtjern. Damtjernite has a structure with large flakes of mica.

In the period from about 1650 to 1927, iron-bearing dolomite was mined and in a period from 1953 to 1963, søveite and dolomite were mined in the Søve mines for the production of niobium.

The discovery in 1652 of iron ore on Fen led to the establishment of Holden Iron Works (Ulefos Iron Works) in 1657. The ironworks in Fossum, Moss and Bolvig also received ore from mines here. The mines were operated until 1881 and operations were only resumed in 1898, the final cessation of operations of the iron mines in the Fens field was in 1927.

During the First World War, there was a shortage of minerals and the Fens field was surveyed. Geologist Waldemar Christofer Brøgger carried out the survey in 1921 and already understood then that igneous limestone was a geological opportunity for finding rare rocks, and in the Fens field he found a number of unknown rocks. During the Second World War, there was again great demand and the German occupation forces began sampling niobium for military purposes. Niobium was to be used in the V1 and V2 rockets that the Germans used over England.

In 1953, Norsk Bergverk started operations and mined niobium in the Søve mines and in 1958 production of ferroniobium began. Ferroniob was made in a metallurgical process where an alloy of iron (40%) and niobium (60%) was produced, during the production it was waste, a radioactive slag. Production was stopped in 1965 but the slag heaps are still there in 2024. In 2020, the Norwegian Nuclear Decommissioning (NND) was commissioned by the Ministry of Trade, Industry and Fisheries (NFD) to take responsibility for the cleanup in the Søve mines.

There were several periods in the 1960s, 1970s and 1980s with systematic mapping of rare earths, but this did not lead to new mining. In the early 2000s, the focus was on the Fens field occurrence of the radioactive element thorium. In 2008, the government presented the report “Thorium as an energy source – opportunities for Norway”. However, there was no political will to develop expertise in nuclear power and thorium.

Test drilling was carried out between 2011 and 2014, and the results showed large amounts of rare earths and relatively little thorium. In 2018, the Geological Survey of Norway (NGU) was granted funding to further map the occurrence of rare earths in the Fens field down to 1,000 meters. The report published in 2019 states that the area may contain Europe’s largest occurrence of rare earths.

Rare earths are important in the green transition. They are needed in a number of high-tech equipment and are included in almost all technical applications that surround us.

Since China has almost a monopoly on rare earths, it is important for Norway and Europe to have a different approach to this for our defense policy and industrial policy. Rare earths are used in everything from torpedoes, vehicles, fighter jets, missiles to radar and communication equipment. With rare earths from the Fens field, Norway can produce this itself, both for us and for our NATO allies. - 2316 views

- Comments

- No comments yet.

- Imperator | Account: -5671003 SHARES. -0

-

Dragonfly Energy Announces Third Quarter 2025 Select Preliminary Results

Preliminary Third Quarter Net Sales and Adjusted EBITDA Exceeded our Guidance

Preliminary Third Quarter Net Sales Represent 26% Year over Year Growth

RENO, Nev., Oct. 13, 2025 (GLOBE NEWSWIRE) -- Dragonfly Energy Holdings Corp. (“Dragonfly Energy” or the “Company”) (Nasdaq: DFLI), an industry leader in energy storage and battery technology, today announced preliminary third quarter 2025 Net Sales and Adjusted EBITDA.

The Company anticipates third quarter 2025 Net Sales of $16.0 million and Adjusted EBITDA of $(2.2) million, above guidance of $15.9 million for Net Sales and above guidance of $(2.7) million for Adjusted EBITDA. Anticipated results represent 26% year-over-year growth in Net Sales and an approximately $3.3 million reduction in Adjusted EBITDA loss.

“ Preliminary third quarter Net Sales and Adjusted EBITDA exceeded our guidance, marking another quarter of year-over-year Net Sales growth and Adjusted EBITDA improvement,” commented Dr. Denis Phares, Chief Executive Officer. “These results underscore our continued focus on driving near-term revenue growth and executing strategic actions, including a recent equity raise, that we believe enhance our financial flexibility and have the potential to position us for sustained net sales growth and profitability. ”

Adjusted EBITDA is a non-GAAP measure and should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with United States generally accepted accounting principles (“GAAP”). Please refer to the reconciliation of Adjusted EBITDA to its nearest GAAP measure in this release.

The third quarter 2025 Net Sales and Adjusted EBITDA are preliminary and are subject to finalization and adjustment in connection with the preparation of the Company’s Quarterly Report on Form 10-Q for the three months ended September 30, 2025. The preliminary financial results included in this press release have been prepared by, and are the responsibility of, our management. During the course of the preparation of our financial statements and related notes as of and for the three months ended September 30, 2025, we may identify items that would require us to make material adjustments to the preliminary financial results presented herein. As a result, investors should exercise caution in relying on this information and should not draw any inferences from this information. This preliminary financial information should not be viewed as a substitute for full financial statements prepared in accordance with GAAP and reviewed by our independent registered public accounting firm.

Third Quarter 2025 Webcast Information

The Dragonfly Energy management team will host a conference call to discuss its third quarter 2025 financial and operational results on Friday, November 14th at 4:30 PM Eastern Time. The call can be accessed live via webcast by clicking here, or through the Events and Presentations page within the Investor Relations section of Dragonfly Energy’s website at https://investors.dragonflyenergy.com/events-and-presentations/default.aspx. The call can also be accessed live via telephone by dialing (646) 564-2877, toll-free in North America (800) 549-8228, or for international callers +1 (289) 819-1520, and referencing conference ID: 68465. Please log in to the webcast or dial in to the call at least 10 minutes prior to the start of the event.

An archive of the webcast will be available for a period of time shortly after the call on the Events and Presentations page on the Investor Relations section of Dragonfly Energy’s website, along with the earnings press release.

About Dragonfly Energy

Dragonfly Energy Holdings Corp. (Nasdaq: DFLI) is a comprehensive lithium battery technology company, specializing in cell manufacturing, battery pack assembly, and full system integration. Through its renowned Battle Born Batteries® brand, Dragonfly Energy has established itself as a frontrunner in the lithium battery industry, with hundreds of thousands of reliable battery packs deployed in the field through top-tier OEMs and a diverse retail customer base. At the forefront of domestic lithium battery cell production, Dragonfly Energy’s patented dry electrode manufacturing process can deliver chemistry-agnostic power solutions for a broad spectrum of applications, including energy storage systems, electric vehicles, and consumer electronics. The Company's overarching mission is the future deployment of its proprietary, nonflammable, all-solid-state battery cells. - 3179 views

- Comments

- No comments yet.

- Shareholder | Account: 1356 SHARES. +270

-

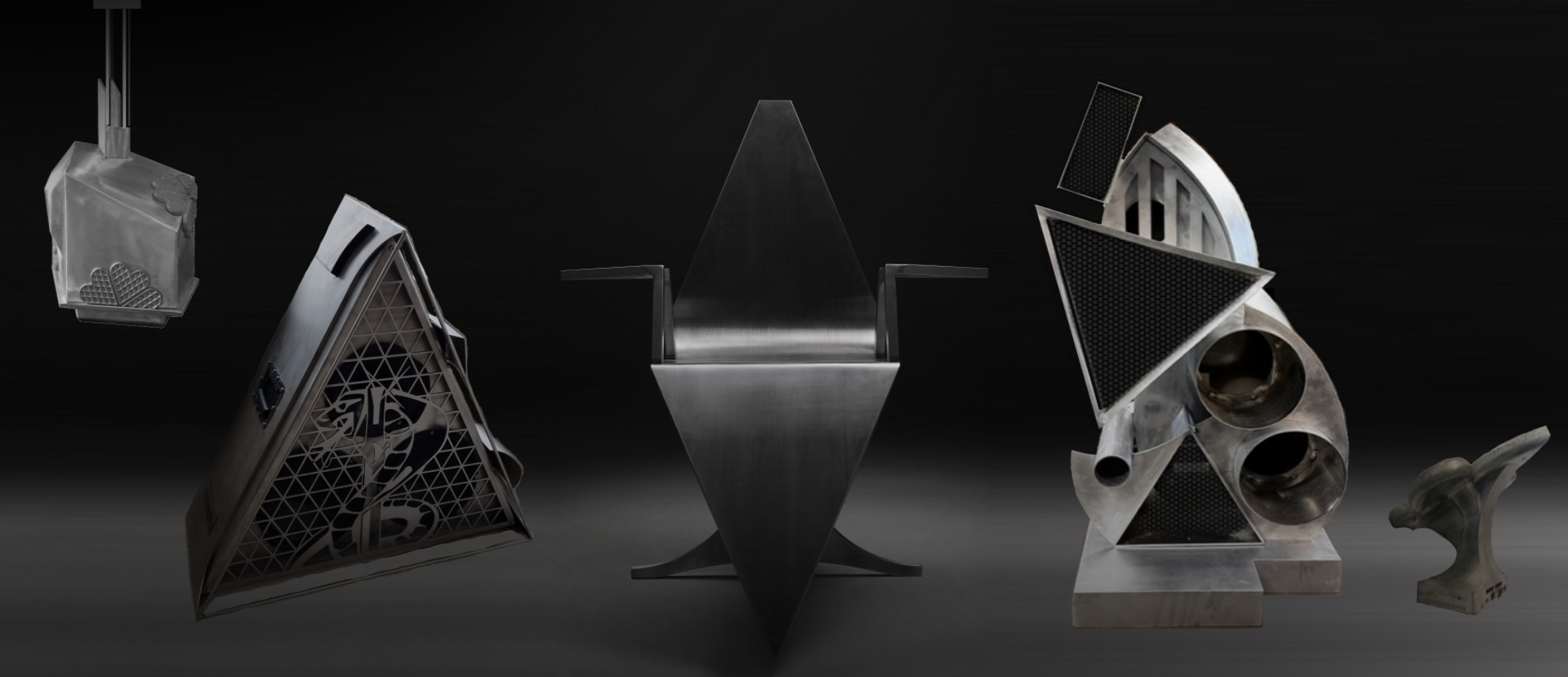

- 4740 views

- Comments

- No comments yet.

- Imperator | Account: -5671003 SHARES. -0

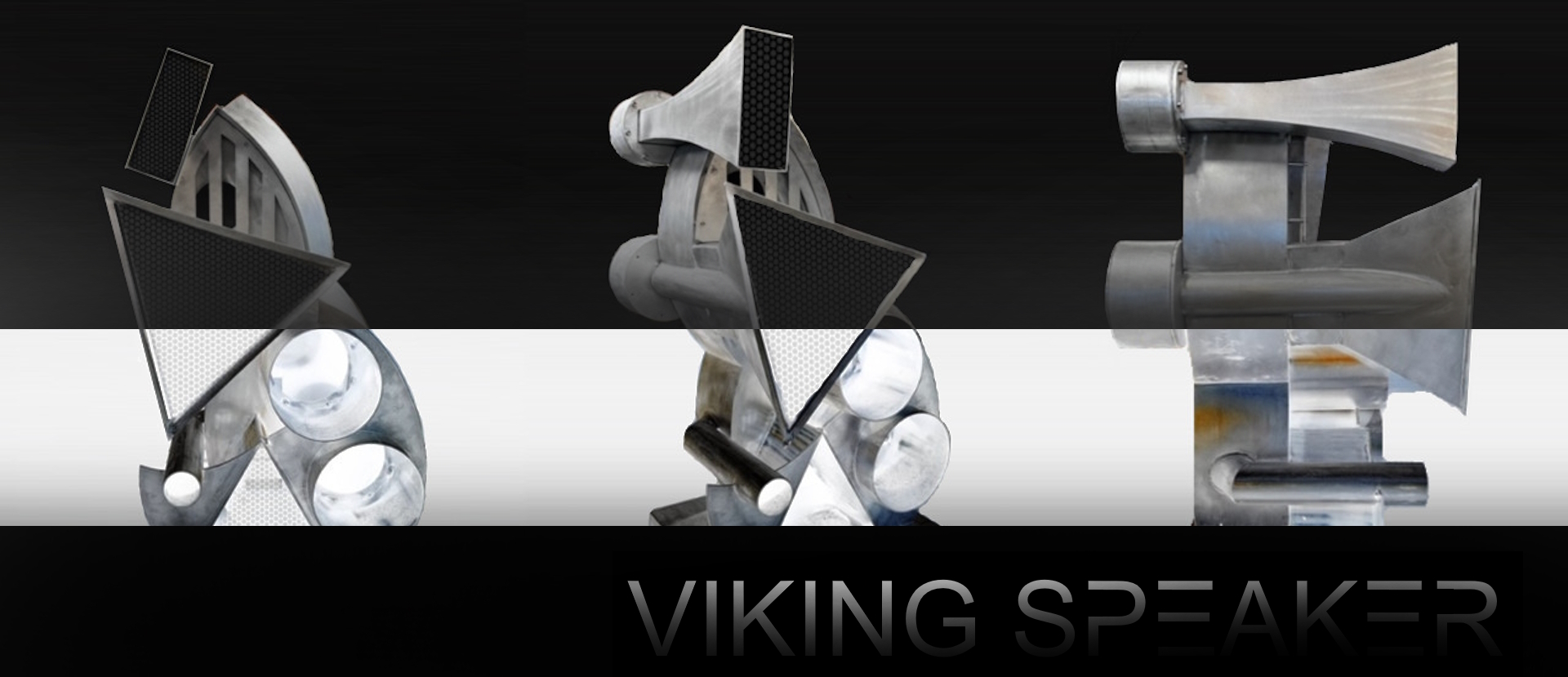

- 5571 views

- Comments

- No comments yet.

Anonymous

Anonymous