- Shareholder | Account: 11900 SHARES. +270

-

- 1203 views

- Comments

-

crayonkisses

You look pretty ready

- Imperator | Account: -5672623 SHARES. -540

- 55379 views

- Comments

- No comments yet.

- Imperator | Account: -5672623 SHARES. -810

- 70612 views

- Comments

- No comments yet.

- Imperator | Account: -5672623 SHARES. -0

-

Hope everyone is well! The Raspberry PC is ready for the stores. Grab one today! The Raspberry PC comes with 16 GB RAM and 512 GB storage.

Hope everyone is well! The Raspberry PC is ready for the stores. Grab one today! The Raspberry PC comes with 16 GB RAM and 512 GB storage.

The Raspberry PC has the most powerful and feature-rich single-board computer from the Raspberry Pi Foundation, delivering up to three times the CPU performance of the Raspberry Pi 4. Notable new features include an in-house developed I/O controller chip (the RP1), a PCI Express interface, and a dedicated power button.

https://raspberrypc.com - 2279 views

- Comments

- No comments yet.

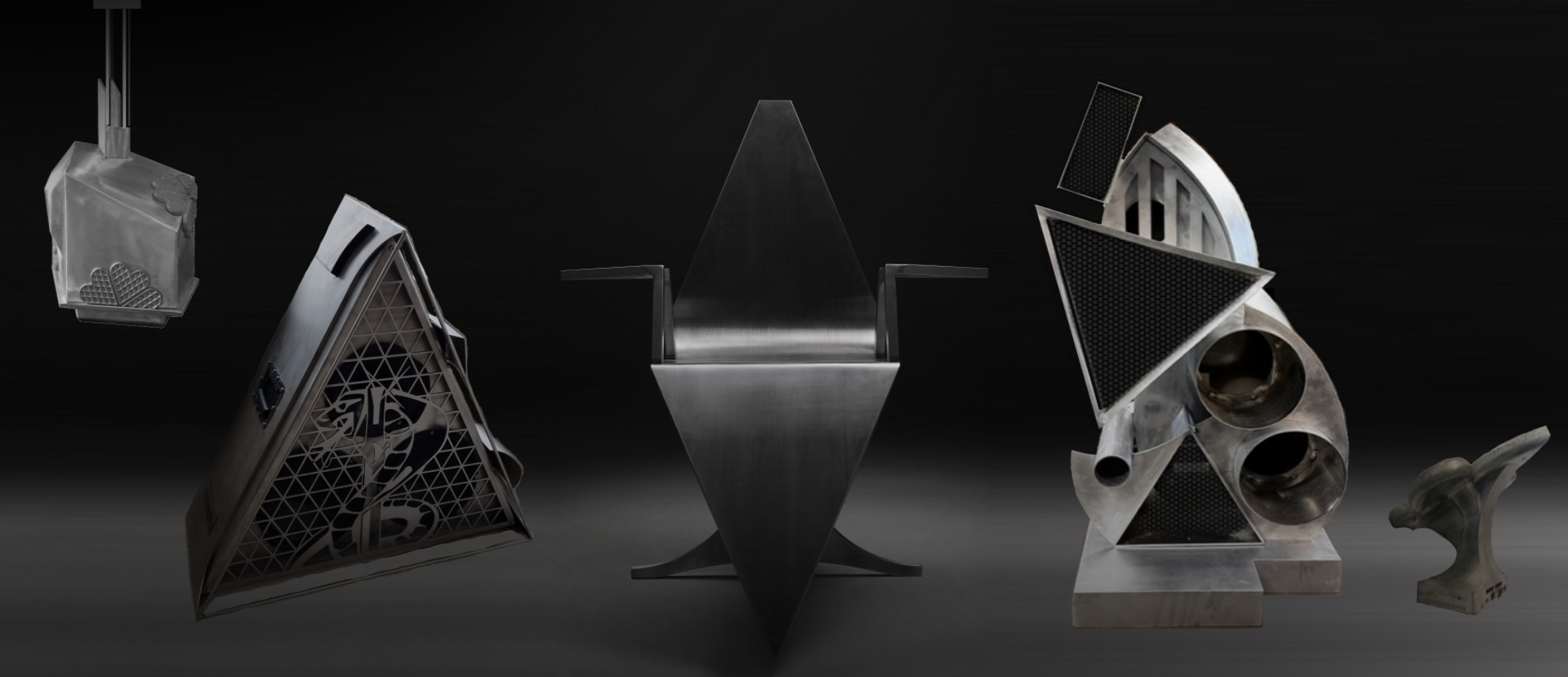

- Imperator | Account: -5672623 SHARES. -540

- 16352 views

- Comments

- No comments yet.

- Imperator | Account: -5672623 SHARES. -270

- 13298 views

- Comments

- No comments yet.

- Imperator | Account: -5672623 SHARES. -270

- 6348 views

- Comments

- No comments yet.

- Imperator | Account: -5672623 SHARES. -0

- 5641 views

- Comments

- No comments yet.

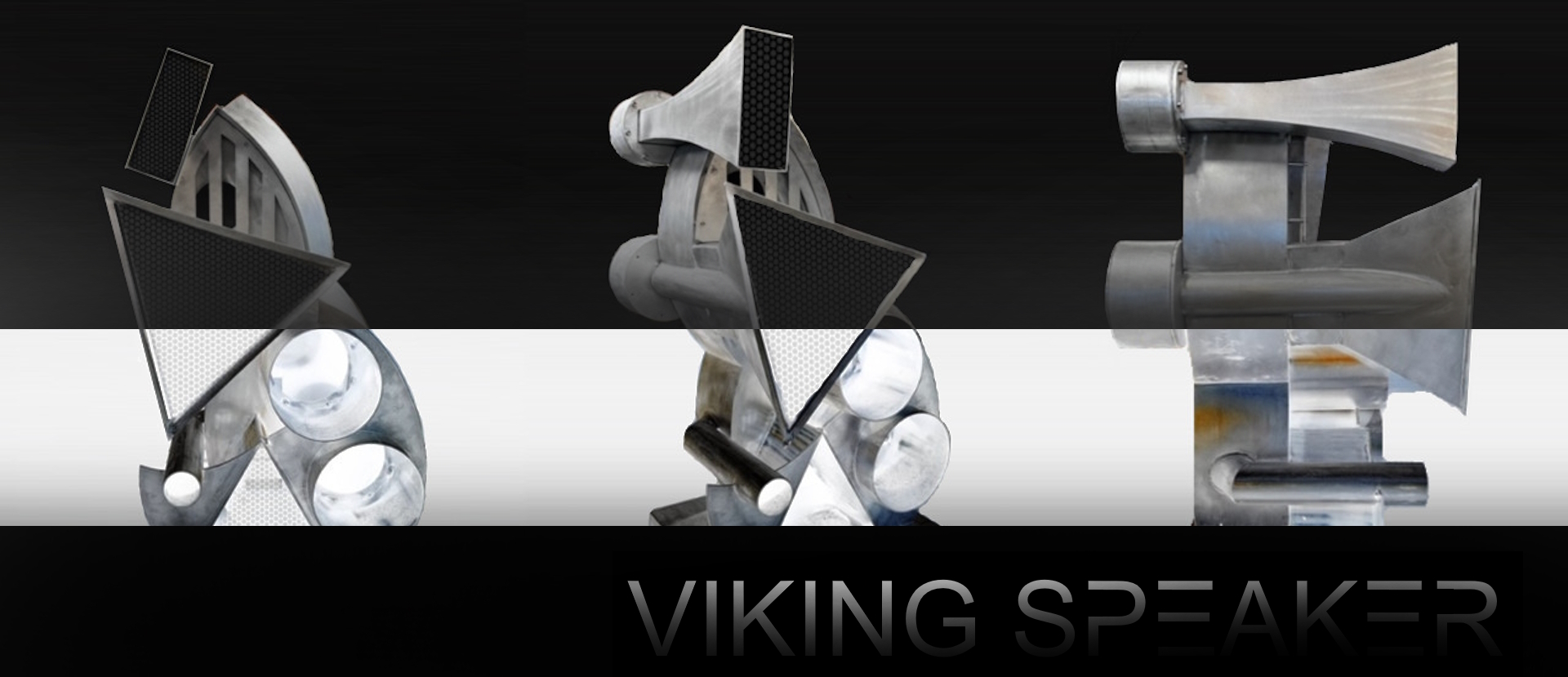

- Imperator | Account: -5672623 SHARES. -270

- 52603 views

- Comments

- No comments yet.

- Shareholder | Account: 121 SHARES. +0

- 6841 views

- Comments

-

Hawkeye

Well doesn't that look tempting?

Hawkeye

Well doesn't that look tempting?

- Shareholder | Account: 121 SHARES. +0

-

"Looking damn good!" - Private Album

- 6846 views

- Comments

-

Hawkeye

Looking damn good!

Hawkeye

Looking damn good!

- Shareholder | Account: 1632 SHARES. +270

-

- 7971 views

- Comments

- No comments yet.

- Shareholder | Account: 82713 SHARES. +0

-

- 7736 views

- Comments

- No comments yet.

Anonymous

Anonymous