- Imperator | Account: -5659753 SHARES. -0

- 1503 views

- Comments

- No comments yet.

- Shareholder | Account: 369703 SHARES. +0

-

"They should be bigger and milkier. I want milk spraying out with each jab to the tit. " - Private Album

- 5055 views

- Comments

-

Thecure

They should be bigger and milkier. I want milk spraying out with each jab to the tit.

Thecure

They should be bigger and milkier. I want milk spraying out with each jab to the tit. -

Haakon_VIII

Hit Me

Haakon_VIII

Hit Me -

crayonkisses

You need to go bigger -

Nick53588

Damn. Nice and perky with a sexy outfit ;) Definitely on the naughty list.

Nick53588

Damn. Nice and perky with a sexy outfit ;) Definitely on the naughty list.

- Imperator | Account: -5659753 SHARES. -0

-

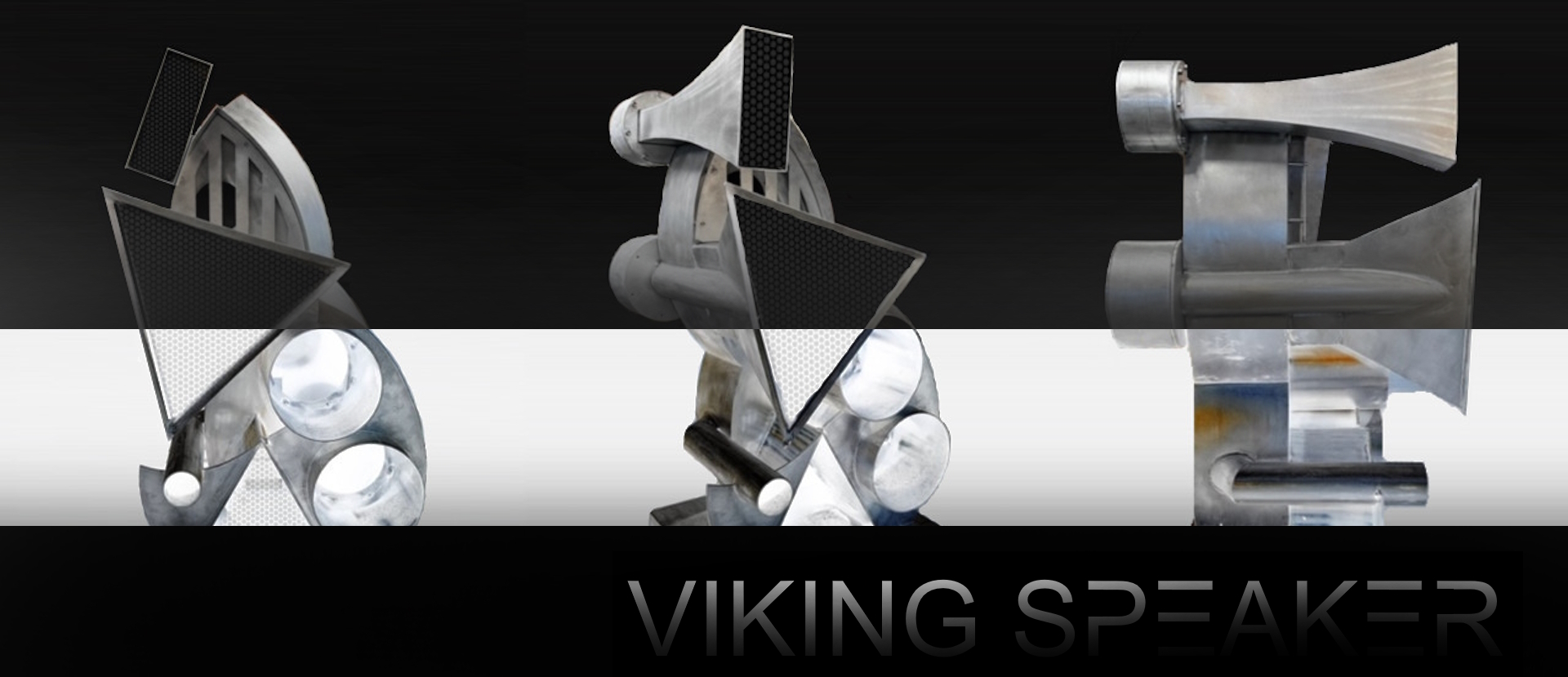

The New Religion features a Broadcom BCM2712 2.4GHz quad-core 64-bit Arm Cortex-A76 CPU and a VideoCore VII GPU with dual 4Kp60 Micro HDMI outputs. Key specifications include LPDDR4X RAM (available in 2GB, 4GB, 8GB, and 16GB configurations), dual-band 802.11ac Wi-Fi, Bluetooth 5.0, Gigabit Ethernet, PCIe 2.0 x1 interface, two USB 3.0 ports, and two USB 2.0 ports. Power is supplied via a 5V/5A DC USB-C connection with Power Delivery support.

Here's a breakdown of the New Religion's main specifications:

Processor

Chip: Broadcom BCM2712

CPU: 2.4GHz quad-core 64-bit Arm Cortex-A76

GPU: VideoCore VII (supporting OpenGL ES 3.1 & Vulkan 1.2)

Memory

RAM: LPDDR4X-4267 SDRAM (available in 2GB, 4GB, 8GB, and 16GB configurations) - 5210 views

- Comments

- No comments yet.

- Imperator | Account: -5659753 SHARES. -270

-

"Hit Me" - Private Album

- 6875 views

- Comments

-

Thecure

They should be bigger and milkier. I want milk spraying out with each jab to the tit.

Thecure

They should be bigger and milkier. I want milk spraying out with each jab to the tit. -

Haakon_VIII

Hit Me

Haakon_VIII

Hit Me -

crayonkisses

You need to go bigger -

Nick53588

Damn. Nice and perky with a sexy outfit ;) Definitely on the naughty list.

Nick53588

Damn. Nice and perky with a sexy outfit ;) Definitely on the naughty list.

- Imperator | Account: -5659753 SHARES. -540

- 40236 views

- Comments

- No comments yet.

- Imperator | Account: -5659753 SHARES. -540

- 43603 views

- Comments

- No comments yet.

- Imperator | Account: -5659753 SHARES. -270

- 68815 views

- Comments

- No comments yet.

- Imperator | Account: -5659753 SHARES. -270

- 35695 views

- Comments

- No comments yet.

Anonymous

Anonymous